Some Known Incorrect Statements About Financial Advisor Fees

Wiki Article

About Financial Advisor Fees

Table of ContentsThings about Financial AdvisorMore About Financial AdvisorThe Greatest Guide To Financial Advisor RatingsWhat Does Financial Advisor Do?

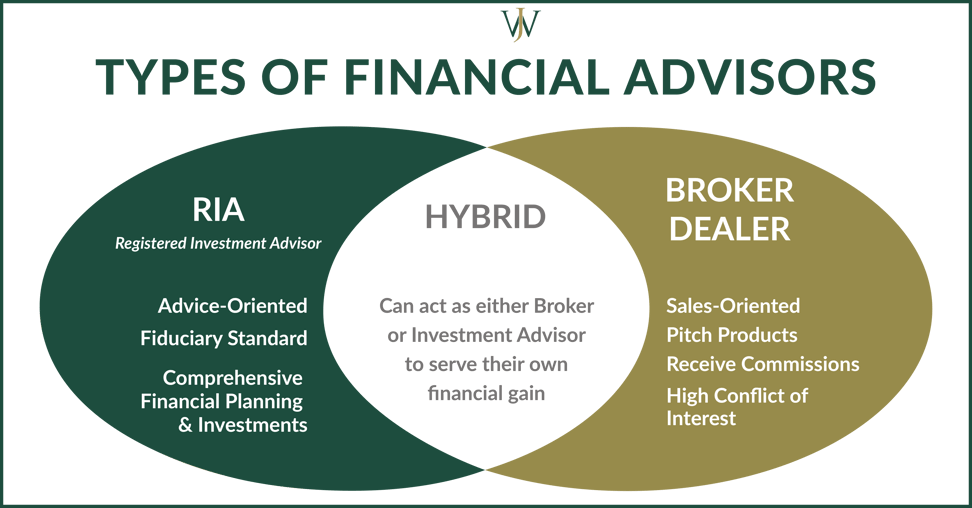

There are numerous sorts of economic experts out there, each with differing qualifications, specializeds, and also levels of accountability. And when you're on the quest for a professional fit to your requirements, it's not unusual to ask, "How do I know which financial expert is best for me?" The answer begins with a sincere accountancy of your requirements and a little of study.Types of Financial Advisors to Take Into Consideration Depending on your economic demands, you might choose for a generalized or specialized financial advisor. As you start to dive right into the globe of seeking out a financial advisor that fits your demands, you will likely be offered with lots of titles leaving you questioning if you are speaking to the ideal individual.

It is very important to note that some economic consultants also have broker licenses (meaning they can offer safety and securities), yet they are not exclusively brokers. On the very same note, brokers are not all accredited just as and also are not economic consultants. This is just among the several factors it is best to begin with a certified economic planner that can recommend you on your financial investments as well as retired life.

9 Simple Techniques For Financial Advisor Near Me

Unlike investment consultants, brokers are not paid straight by clients, instead, they earn commissions for trading supplies as well as bonds, and also for marketing shared funds and also other items.

You can normally inform an expert's specialized from his/her financial qualifications. A certified estate coordinator (AEP) is an expert who specializes in estate planning. When you're looking for an economic advisor, it's nice to have a concept what you desire help with. It's also worth pointing out monetary planners. advisors financial asheboro nc.

A lot like "financial advisor," "monetary planner" is likewise read the article a wide term. Regardless of your specific requirements and also monetary scenario, one standards you must strongly take into consideration is whether a potential advisor is a fiduciary.

The smart Trick of Financial Advisor Magazine That Nobody is Talking About

To shield yourself from someone that is just trying to get even more money from you, it's a great suggestion to try to find an expert who is registered as a fiduciary. A monetary expert that is registered as a fiduciary is needed, by law, to act in the very best passions of a client.Fiduciaries can just suggest you to use such items if they assume it's actually the very best financial choice for you to do so. The U.S. Securities and Exchange Commission (SEC) regulates fiduciaries. Fiduciaries that fall short to act in a client's benefits might be hit with fines and/or imprisonment of as much as ten years.

Nonetheless, that isn't because anyone can obtain them. Receiving either certification needs a person to go via a variety of courses and tests, along with making a collection quantity of hands-on experience. The outcome of the certification procedure is that CFPs and also Ch, FCs are skilled in topics across the field of personal financing.

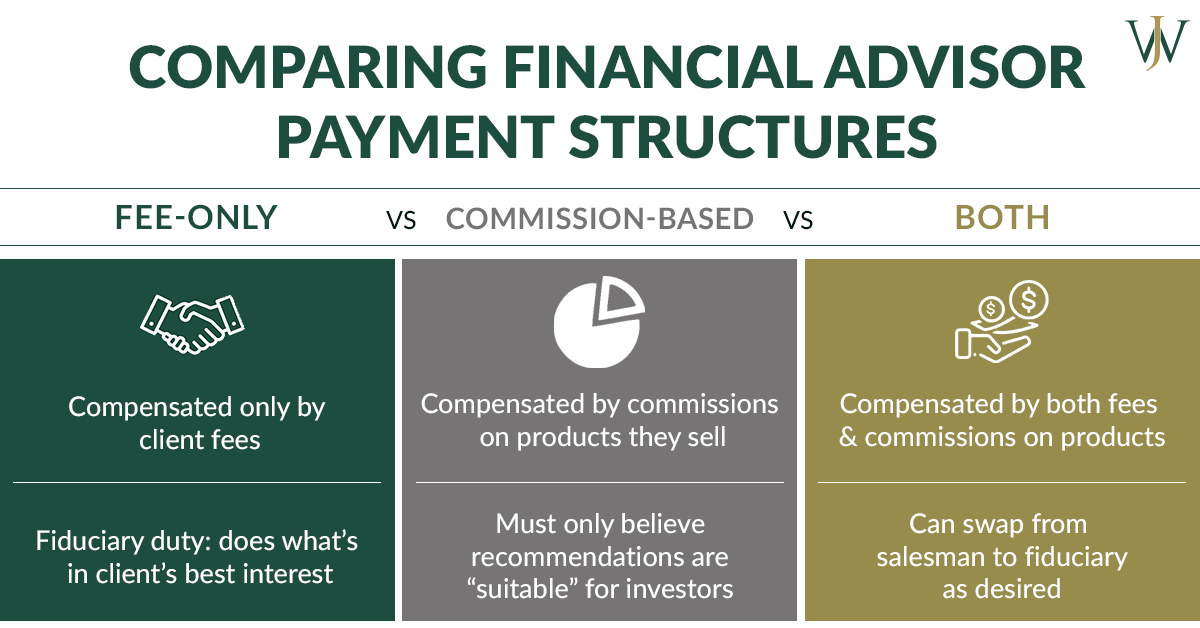

The fee could be 1. Fees generally lower as AUM boosts. The alternative is a fee-based advisor.

What Does Financial Advisor Magazine Mean?

A consultant's monitoring charge may or might not cover the expenses connected with trading safeties. Some advisors additionally bill a set cost per purchase. Make certain you recognize any kind of and also all of the fees a consultant costs. Find Out More You don't desire to place every one of your cash under their control just to handle concealed shocks in the future.

This is a solution where the expert will certainly bundle all account management costs, consisting of trading fees as well as expenditure proportions, into one thorough cost. Since this cost covers more, it is normally greater than a fee that just includes administration and also omits points like trading prices. Wrap fees are appealing for their simpleness yet additionally aren't worth the cost for everybody.

They likewise charge costs that are well below the advisor fees from conventional, human experts. While a typical advisor generally bills a charge between 1% as well as 2% of AUM, the charge for a robo-advisor is usually 0. 5% or much less. The big compromise with a robo-advisor is that you frequently don't have the capacity to speak with a human expert.

Report this wiki page